If you’re starting a business, whether as a freelancer or solopreneur and can’t quite justify an accountant, one of the ways you can become more organized is by using online accounting software.

Not only does it save you hours of bookkeeping time, but it also meets your budget and needs, while improving the efficiency of your business.

We’ve compiled a list of 6 of the best online accounting software options available today, each with benefits that’ll help you manage time, billing, accounting and clients better. You can review them all in terms of ease of use, features, and pricing to find the best fit for your needs.

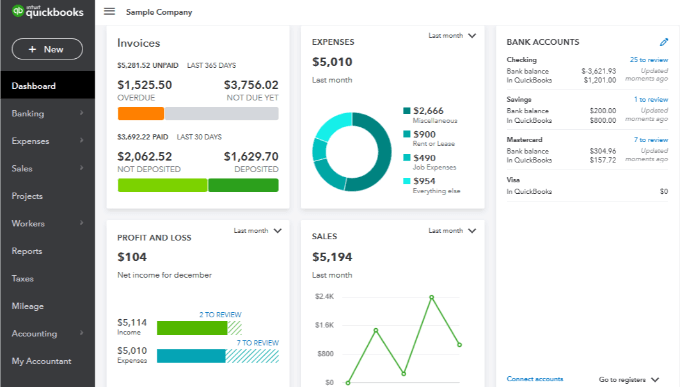

1. Intuit QuickBooks Online

QuickBooks is the most widely used online accounting software thanks to its user-friendly interface and wealth of features.

It also scales as you grow, and makes it easy for new users to learn how it all works by offering tutorials, videos, and guides. A help forum is available too, though it may take longer for you to find an accurate and correct answer to your query.

Intuit seems to be slowly phasing out its desktop version of the software to focus more on this online version, but you can still migrate to the online version if you’ve been using the desktop version.

No matter the size or shape of your business, there’s a package that’s suitable for your needs. It may be pricier than its competitors, but it delivers more value by saving your business more time and resources.

All its pricing plans come with unlimited support via chat or phone, the ability to connect credit card or bank accounts, and accept online payments. They also offer access to financial statements such as balance sheet and profit and loss.

More advanced QBO plans let you track inventory and time, manage 1099 contractors, and run full service payroll.

You can install its easy-to-use clients on Windows or macOS for the desktop, though the Mac version has fewer features compared to Windows or the online version. Besides browser accessibility, you can get QBO for mobile devices by downloading the Android or iOS app.

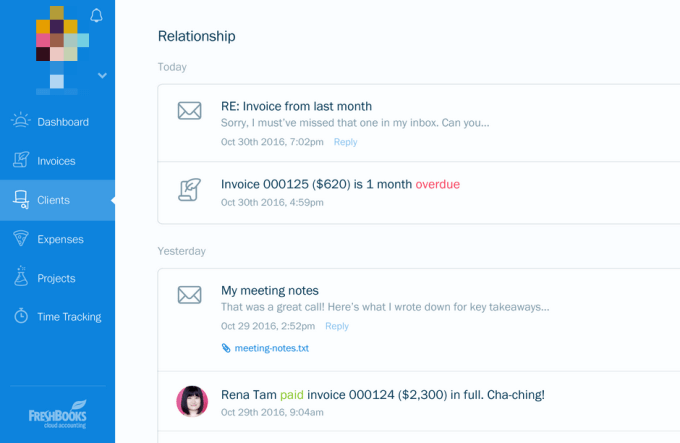

2. FreshBooks

FreshBooks is an excellent tool for solopreneurs and freelancers looking for a simple accounting system to streamline invoicing and payment collection.

It’s intuitive, well-rounded, and one of the easiest online accounting software tools you can use for invoicing, time tracking, payments and reports.

Some of its features include double-entry accounting, support for project tracking, ability to track work hours, and more than 100 custom invoice templates. It also shows the location where your customer opened your invoice so they don’t send you pesky excuses that they never received it.

If you send out recurring invoices, run a subscription model business, or need time tracking for yourself or your contractors, FreshBooks could be ideal for you.

It integrates with many business apps and offers a dashboard where you can manage your accounting and finances.

Also included is a mobile app for Android or iOS devices so you can keep track of your business on the go, and take regular, secure backups.

3. Wave

Wave is a free online accounting software tool designed for businesses on a tight budget.

It stands out among other accounting software as it offers most of its features for free, such as the ability to track your finances in one platform instead of moving from one app to another for different personal and business finances.

You also get free invoicing and receipts, but you’ll pay a fee when you want to use services like personal technical support, payroll or payment processing, which are integrated with its bookkeeping suite of tools.

The main drawback with this accounting software is that it’s not as in-depth as QuickBooks and other options on this list, but it should work fine if you just have basic needs. It also doesn’t track and pay vendor bills, and serves you with ads as you’d expect with any free online service.

Mobile apps for Android and iOS devices are available, though not as comprehensive as with other accounting software.

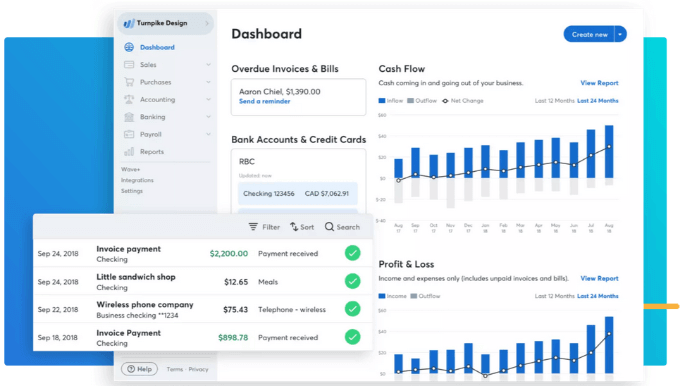

4. Zoho Books

Zoho Books is part of the Zoho cloud software suite. It’s an online accounting software app that helps you manage your money while giving you complete visibility of your finances.

It’s ideal for small businesses with a small number of employees, inventory, and simpler needs to help manage cash flow and finances.

Zoho Books takes pride in its straightforward usability, and provides easy-to-understand graphs and dashboards, and automated payment reminders for customers who don’t pay on time. Plus, it offers financial statements, manual journal entries, inventory and collaboration tools, and much more.

It also integrates with other applications in the Zoho suite of products so you don’t have to use several apps to manage your business. This sets it apart from other accounting software tools in this list.

Its main drawback is its limited payroll offering, which may cause some users to find a different software with this function.

All its pricing plans include the ability to accept online payments, give multiple users access to financial records, credit card and bank account feeds, and support for financial reports like balance sheets or profit and loss. Mobile apps for Android and iOS devices are also available.

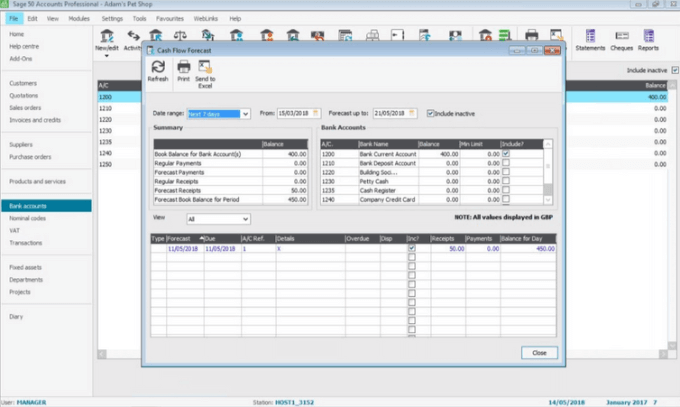

5. Sage 50cloud

This is a robust online accounting application for small businesses. It’s a complete desktop accounting software that lets you focus more on developing your business instead of spending time managing your accounts.

Its user interface is easy to use for small businesses and entrepreneurs to operate effectively and efficiently. Plus, it offers a comprehensive set of financial tools and customization options.

Sage 50Cloud is ideal for small and medium-sized businesses, and provides tools for invoicing, tracking payments and expenses, and calculating taxes.

What you don’t get though are time tracking and collaboration tools. Payroll isn’t included as well, because it’s offered as a separate product.

The software integrates with Microsoft Office 365, which means you can share data in the cloud with productivity apps.

It doesn’t have a dashboard though, and it’s a bit pricey compared to similar options on this list. However, you’ll get access to an exceptionally sophisticated feature set plus great customization options, plus Android and iOS mobile apps for your convenience.

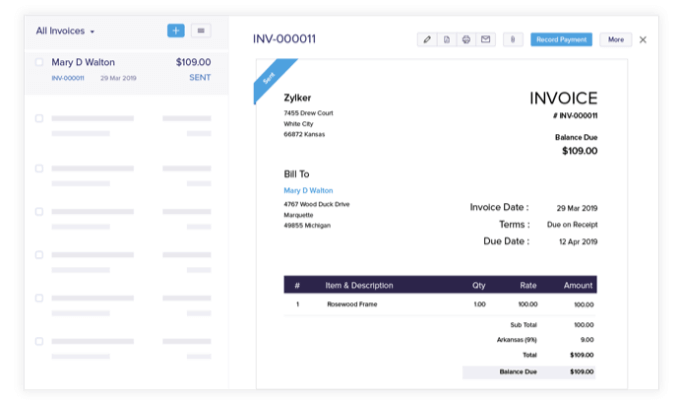

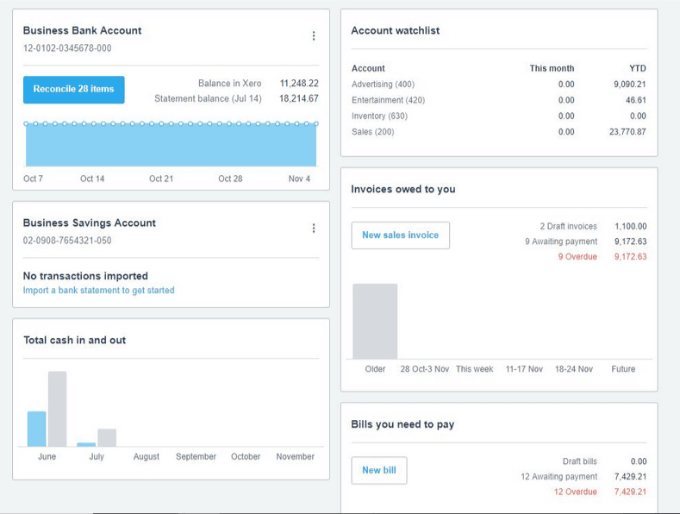

6. Xero

Xero is the go-to online accounting software for business owners who want an alternative to QuickBooks.

It offers almost all the features you’d find in QuickBooks except it doesn’t charge a fee per user, or limit how many users you can have. Its 24/7 live chat support is also available for free.

Some of its strengths include project tracking, time tracking, document management, inventory management, data imports and account reconciliation. It also integrates with more than 600 other applications so that you can manage your inventory, invoicing and payroll (offered through Xero’s partnership with Gusto) better.

All its pricing plans include features such as connection to bank and credit card accounts, unlimited number of users and email tech support, plus access to important financial statements.

If you conduct most of your business on the go, Xero offers mobile apps for Android and iOS so you can send custom invoices, manage and track inventory, and create and attach purchase orders to bills from your tablet or phone.

Get Your Finances in Order

The best online accounting software is easy to use, allows you to track your time, income, and expenses, and is affordable. It should also provide key financial statements so you can see the financial health of your business.

When choosing the right one for your needs, make sure it has (at the very minimum) features such as custom invoicing, integration with credit card and bank accounts, detailed reports, tax tracking, and accessibility so you can get your information from anywhere and anytime you want.