For entrepreneurs and freelancers alike

You were bitten by the entrepreneurial bug, and now you’re starting your own business. Or maybe you’re an established freelancer who’s looking to go legit. Either way, you’re going to need a professional approach to invoicing your clients and customers. Lucky for you, there are dozens of online options to choose from.

If you’re the type who struggles with making a final decision, then we’re here to help. Let’s take a look at the top seven online invoicing services you should consider using.

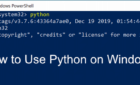

Invoice Ninja

Here’s an excellent place to start if you’re just entering the world of entrepreneurship. It comes with a free version, which is ideal for professionals with less than a hundred clients and a shaky budget.

Otherwise, you can upgrade to “Ninja Pro” for just $8/month. You can do this on the anniversary of getting your 101st client. In doing so, you’ll be able to invoice an unlimited number of clients.

Free and paid versions of this online invoicing service both come with:

- Auto-billing / recurring invoices.

- Custom quotes.

- Project & task management using Kanban boards.

- Time-tracking tools.

The platform is 100% web-based, and you get access to pro invoice and quotation templates. Plus, you’ll also be able to accept payments through 45 different payment processors.

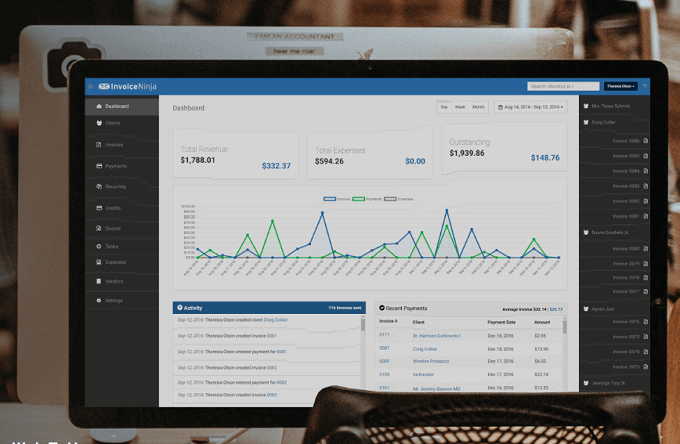

Practice Panther

Practice Panther is a flexible online invoicing platform that allows users to bill customers however they deem fit. Like to charge by the hour? Great. Prefer to charge a flat rate or by the item? No biggie.

Then if you have a Google account, you can sync it to connect with your contact list and calendars.

There’s a free plan you can use for a trial run. Just be prepared to be limited to three clients. Then when you’re ready to upgrade, you will pay $15/month. This will allow you to have up to two users and 500 clients.

The online invoicing service also allows:

- Credit card payments via the invoice.

- Syncing with Quickbooks online.

- Access via a mobile app.

- Tracking of time and expenses.

- Sending messages via a client portal.

Then as their site states, you can generate invoices in a click.

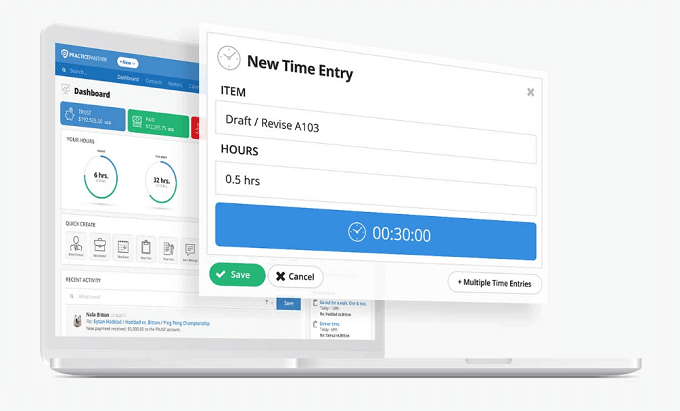

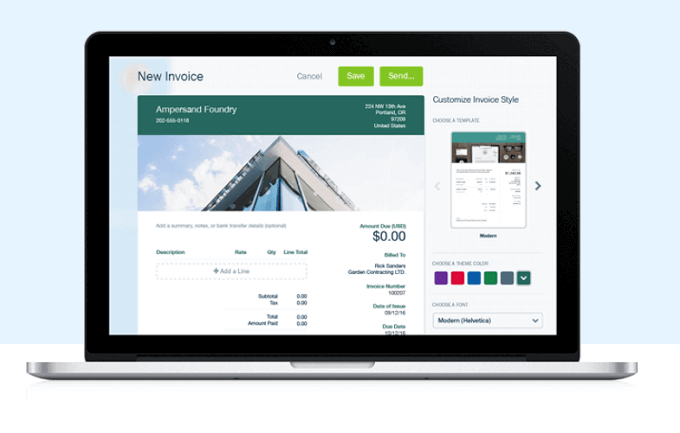

Freshbooks

Freshbooks is another go-to invoicing platform for the small business guy (or gal). It’s the tool you use when you’re ready to do bigger and better things, and need invoicing software that will represent your professionalism accordingly.

Here’s a quick rundown of what it can do:

- Create and send pro invoices (and estimates).

- Automate invoice alerts.

- Access your dashboard from a mobile device.

- Create detailed annual reports for tax season.

- Accept payments through Paypal, credit card, etc.

- Capture expenses using the mobile app.

Freshbooks is ideal for entrepreneurs, as well as teams and agencies. There’s a free trial you can use to test the platform. Then once you’re ready, you can upgrade to Lite for $15/month.

However, you only get up to five billable clients and unlimited invoices. The next step up is $25/month for 50 billable clients and $50/month for 500 billable clients.

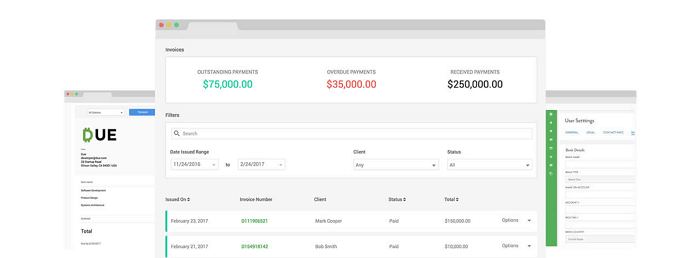

Due

Are you a penny-pinching business owner? If so, then you’ll like Due. So far, it has the lowest processing rate (to date) at 2.8%. Others normally charge 2.9% + $.30 per transaction.

However, this doesn’t take away from its robust capabilities. Due comes with much-needed features, including:

- Time tracking.

- Unlimited invoices.

- Integration with PayPal and Stripe.

- Apply sales tax, discounts, and tips.

- Data export.

- Multi-currency transactions.

- Accept eWallets, credit/debit cards, international payments, and eChecks.

You can get started with Due for free to see if it’s right for you and your business.

Quaderno

Quaderno makes it to the list because it’s designed for people just like you. It’s created for freelancers and other entrepreneurs who desire a simple platform to use.

It generates reports, which can help you to make better financial decisions. Other features it comes with include:

- Automated invoicing.

- Customizable receipts.

- Maintained tax compliance around the world.

- Send automated receipts in a single click.

The prices are tiered, starting at $49/month for startups. This allows up to 250 transactions monthly. Then you can upgrade to $99/month for up to 1,000 transactions monthly.

Tipalti

As a business owner, you have to wear several hats. At least, if you want to save money. With Tipalti, you get a tax-compliant invoicing system.

The app is certified by KPMG, so all of the necessary US tax forms are automatically collected. In other words, you can easily submit your 1099 forms at the end of each year using the financial details on the platform.

This is tax reporting made easy for you and your team (if you have one). Plus, you get detailed reports auto-generated, which you can use for other purposes (like proof of income). Goodbye, accountant and bookkeeper?

Then it integrates with tools like:

- NetSuite.

- Quickbooks.

- HitPath.

- CAKE.

- LinkTrust.

You can test everything out for yourself by signing up for a free trial.

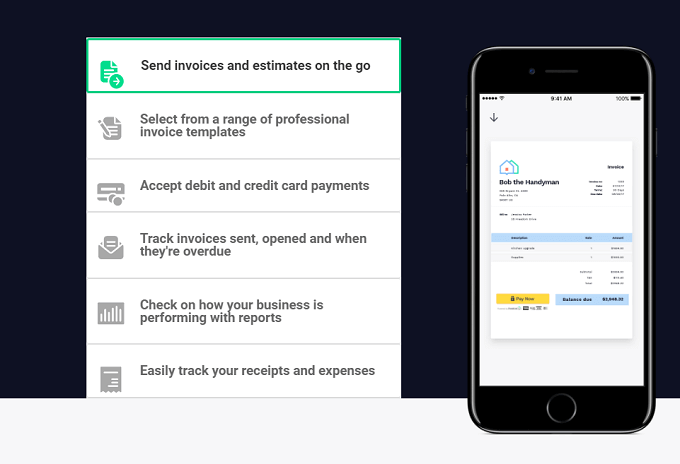

Invoice2Go

You’re not the typical entrepreneur sitting behind a desk all day. In fact, you’re always on the move meeting with clients and doing whatever else go-getters do.

So you need an online invoicing platform that accommodates your business needs. Invoice2Go is a go-to choice for business owners who need access to invoicing tools on their mobile devices.

You can use your tablet or smartphone to send invoices and estimates, as well as accept payments.

Need to check your receipts and expenses? You can check it right from your phone. It’s also easy to see which invoices are still pending and even your business’s financial performance.

The platform’s prices also scale with you, starting at $2.99/month for up to 50 invoices and five clients. Then you can upgrade to a plan for $10/month for 200 invoices and up to 25 clients. Or go unlimited for $34/month.

Go Professional with an Online Invoicing Service

It’s not enough to build a website, create a logo, and attract customers. If you don’t have a professional way to bill them, then you could lose revenue (and your customers).

When you’re starting out, you need to establish yourself as a trusted and legit company. Yet, if you’re sending out paper invoices, or calling clients and demanding they pay over the phone with a credit card, you’re doing the exact opposite.

Make it convenient for your customers to do business with you by using one of the best online invoicing services on this list. Then let us know which one you stick with!